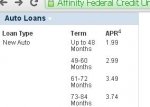

So I finally test drove a Fiesta ST this past weekend! It drives really well. I didn't explore the car's power too much (being a test drive, and that it wasn't properly broken in yet) but I could feel the pull in 2nd gear  . I also kept in mind that this was with the truncated stock tune, which is nice to know that there is room to easily grow. After the test drive, we went inside to discuss financing. They had only one ST on the lot, and it wasn't exactly the options that I wanted, so I plan to order one (Tuxedo Black, navigation, moonroof, standard seats, Rado Gray wheels, and the ST protection package). Unfortunately, the dealer was about to close, so we only discussed financing options, rather than setting anything in stone. However, before leaving, I was told that I had two options: $1000 "Switch Cash," or 0% APR. I asked the salesman what my interest rate would be if I opted for the Switch Cash instead of the 0% APR, but he did not have that info off hand. I was curious to see which is the better deal. To get a rough idea, I went home and researched a few random banks' auto financing. It looks like the average rates today are around 2.5% to 3%. However, being that Ford wants to sell cars, their rate may be a bit lower than say Bank of America's would be. Checking the "Ford Credit" website didn't yield a clear answer either. Does anyone on here know?

. I also kept in mind that this was with the truncated stock tune, which is nice to know that there is room to easily grow. After the test drive, we went inside to discuss financing. They had only one ST on the lot, and it wasn't exactly the options that I wanted, so I plan to order one (Tuxedo Black, navigation, moonroof, standard seats, Rado Gray wheels, and the ST protection package). Unfortunately, the dealer was about to close, so we only discussed financing options, rather than setting anything in stone. However, before leaving, I was told that I had two options: $1000 "Switch Cash," or 0% APR. I asked the salesman what my interest rate would be if I opted for the Switch Cash instead of the 0% APR, but he did not have that info off hand. I was curious to see which is the better deal. To get a rough idea, I went home and researched a few random banks' auto financing. It looks like the average rates today are around 2.5% to 3%. However, being that Ford wants to sell cars, their rate may be a bit lower than say Bank of America's would be. Checking the "Ford Credit" website didn't yield a clear answer either. Does anyone on here know?

I will probably be returning before the end of the month, as Ford's website says that I must "take new delivery from dealer stock by 2/2/15." I'm hoping that means that I can place the order by 2/2/15, as it's highly unlikely that I'll take "delivery" before then. I hear that it will take weeks for an ordered car to arrive. That's fine by me, as the rock salt season will be ending lol. Though, should I hold off even longer, until next month to make the purchase? Will they have better deals after 2/2/15? Usually the longer you wait, the better the incentives. However, I don't want to wait too long and miss the cut off for placing a custom order. When is the deadline to make a custom car order? I'd like an ST, but one just for me! ha. All the ones that I've seen on lots so far are either fully loaded, or base model STs.

I noticed something strange in the fine print of the 0% APR offer, "0% APR financing for 60 months at $16.67 per month per $1,000 financed regardless of down payment." What exactly does this mean? This seems a little fishy. It's not truly 0% if we have to pay for the 0% rate. It seems like an interest charge, simply re-worded. That could come out to be an extra car payment tacked onto the loan.

I also noticed that in the fine print (bold print above) there was no mention about the $16.67 charge being applied for 48 months. It only mentions a charge for 60 months. With a true 0% APR rate, I was planning on going with 60 month financing, paying off more per month when I can. However, if I have to "pay" for a 0% APR on a 60 month loan, should I opt for the 48 months instead? I mean, if 48 and 60 month financing were both 0% APR, the 60 month option would be the better choice, as I can always pay more per month if I wanted, but if I have to "pay" for financing, it will probably cost more in the long run to opt for 60 months over the 48 months, right? A whole car payment more actually (~$23,000 x $16.67 = $384). The "regardless of down payment" part is also very lame, because even if someone had $5,000 to put down, they'd still have to pay that $16.67 on the full price of the car?

Also, for reference, my credit rating is in the 700 range across all three bureaus. I was told that I wouldn't have an issue getting approved.

Hopefully someone can help clear this up for me! I'd love to get behind the wheel of an ST![Cool Smile [coolsmile] [coolsmile]](/images/smilies/cool.png) , but I want to fully understand what I'm getting into before I walk back in that door.

, but I want to fully understand what I'm getting into before I walk back in that door.

I will probably be returning before the end of the month, as Ford's website says that I must "take new delivery from dealer stock by 2/2/15." I'm hoping that means that I can place the order by 2/2/15, as it's highly unlikely that I'll take "delivery" before then. I hear that it will take weeks for an ordered car to arrive. That's fine by me, as the rock salt season will be ending lol. Though, should I hold off even longer, until next month to make the purchase? Will they have better deals after 2/2/15? Usually the longer you wait, the better the incentives. However, I don't want to wait too long and miss the cut off for placing a custom order. When is the deadline to make a custom car order? I'd like an ST, but one just for me! ha. All the ones that I've seen on lots so far are either fully loaded, or base model STs.

I noticed something strange in the fine print of the 0% APR offer, "0% APR financing for 60 months at $16.67 per month per $1,000 financed regardless of down payment." What exactly does this mean? This seems a little fishy. It's not truly 0% if we have to pay for the 0% rate. It seems like an interest charge, simply re-worded. That could come out to be an extra car payment tacked onto the loan.

I also noticed that in the fine print (bold print above) there was no mention about the $16.67 charge being applied for 48 months. It only mentions a charge for 60 months. With a true 0% APR rate, I was planning on going with 60 month financing, paying off more per month when I can. However, if I have to "pay" for a 0% APR on a 60 month loan, should I opt for the 48 months instead? I mean, if 48 and 60 month financing were both 0% APR, the 60 month option would be the better choice, as I can always pay more per month if I wanted, but if I have to "pay" for financing, it will probably cost more in the long run to opt for 60 months over the 48 months, right? A whole car payment more actually (~$23,000 x $16.67 = $384). The "regardless of down payment" part is also very lame, because even if someone had $5,000 to put down, they'd still have to pay that $16.67 on the full price of the car?

Also, for reference, my credit rating is in the 700 range across all three bureaus. I was told that I wouldn't have an issue getting approved.

Hopefully someone can help clear this up for me! I'd love to get behind the wheel of an ST

![Cool Smile [coolsmile] [coolsmile]](/images/smilies/cool.png) , but I want to fully understand what I'm getting into before I walk back in that door.

, but I want to fully understand what I'm getting into before I walk back in that door.